Welcome to the June 2022 Edition of the BFG Report

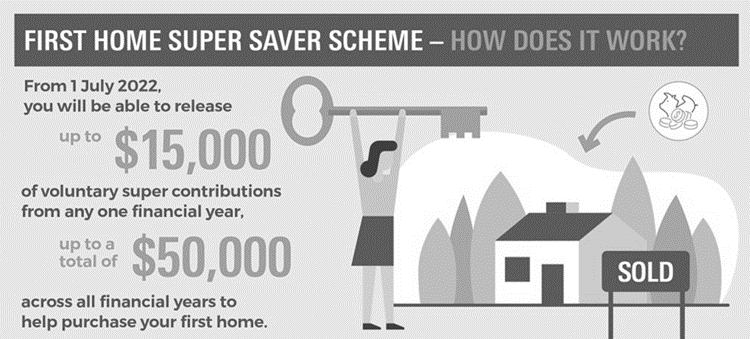

First Home Super Saver scheme – how does it work?

From 1 July 2022, if you’re a first home buyer you can release up to $50,000 (up from $30,000) from your voluntary super contributions to help you buy your first home. Under the scheme, voluntary concessional and non-concessional contributions made on or after 1 July 2017 may be released from super to help you purchase your first home.

Currently, you can release up to $15,000 of voluntary contributions from any one financial year, up to a total of $30,000 in contributions across all financial years, plus earnings on those voluntary contributions. Under the new rules, from 1 July 2022, you will be able to release up to $15,000 of voluntary contributions from any one financial year, up to a total of $50,000 contributions across all financial years, plus earnings.

To be eligible to participate in the FHSS scheme an individual must:

- be 18 or over

- have never owned property in Australia

- not previously requested a release of super money under the FHSS scheme.

The FHSS scheme can only be used to buy a residential home in Australia however, it cannot be used to buy a mobile home. If vacant land is purchased, a contract to build a home on it must be signed within 12 months although a 12-month automatic extension will be granted. You must also intend to live in the home, the scheme can’t be used to buy a residential investment property.

There are certain details around the withdrawal amount, associated earnings, tax on withdrawal and the release of the funds.

Investment Market Review – June 2022

The volatility that we’ve seen over the last six months, while significant, is not an unusual occurrence for a normal and healthy functioning market.

With our core mission being “assisting clients to make smart decisions about their wealth” your portfolio structure includes assumptions on certain risks, like share prices falling, that will occur over the longer term.

We set up your portfolio with other investments like cash (including term deposits) to help reduce the impact of this risk on your wealth. Hence diversification is core to your portfolio’s function and considers the market environment.

We appreciate that the current environment looks concerning given falls in markets and likely further interest rate rises during 2022, with the possible risk of recession, however it is important to continue to stay invested and manage your portfolio in line with your long-term objectives, aligned to your risk tolerance.

Key Points

- Stock and Bond Markets have fallen dramatically in recent weeks, continuing the trend since the start of 2022.

- High inflation in the U.S. was the cause – coming in at 8.6%. The highest in 40 years. This prompted the U.S. Federal Reserve to raise interest rates by 0.75%. Domestically, the RBA raised rates by 0.5%.

- The Inflation is being caused by a range of factors, including supply chain disruptions due to the COVID crisis and the war in Ukraine.

- Investors fear that rising interest rates, to combat inflation, will hurt economic growth and cause a recession.

- Fear of slower economic growth has hurt the share market, which performed strongly in 2020 and 2021.

- Stocks market and Bond market falls means they are now more attractively priced.

- It is important to take a long-term view and stay invested, with diversification, in line with your risk tolerance.

- Time in the market, is more important than timing the market.

Outlook

We expect inflation and interest rates to continue rising in 2022. This will have an effect in the short-term, dampening economic growth. We also expect inflation to reduce in 2023 and this should take pressure off the global economy. This is because the supply side shocks should reduce as the world opens up after the COVID crisis.

An end to the war in Ukraine would also help the inflation situation, as the supply of many key commodities would increase.

Markets have fallen substantially and are therefore more attractively priced than recent all-time highs at the end of 2021. There are asset classes that should do well in the coming periods, including floating rate Bond markets and asset classes that benefit from inflation – e.g., Infrastructure and Commodities.

High Yielding Internet Savings Accounts

| Financial Institution | Interest Rate** | Financial Institution | Interest Rate** |

| ING Savings Maximiser | 2.10% p.a. | Macquarie – Savings Account | 1.80% p.a. |

| RaboDirect Bank | 2.10% p.a. | Great Southern Bank – Goal Saver | 1.40% p.a. |

| UBank – Save Account | 1.85% p.a. | ME Bank Online Saver | 1.10% p.a. |

| Australian Unity – Active Saver | 1.20% p.a. | IMB – Reward Saver | 1.00% p.a. |